Brookfield Asset Management Canadian alternative Investment major is planning to raise $500-$700 million by Real Estate Investment Trust by the end of this financial year. Investment bankers have already started to monetize Indian assets using REIT listing.

Currently, Brookfield owns 22 million sq. ft office properties as real estate assets in India. The exact amount of assets they will be offering will be notified soon.

Finally, India’s REIT segment is catching fire with large portfolio owners by gearing up after the performance of maiden REIT Embassy Office Parks. The REIT has been backed up by Embassy Group & US private equity major Blackstone Group. They have provided 22% of returns since the listing along with 14% price appreciation and distribution.

The second-largest REIT, Mindspace Business Parks is backed up by K Raheja Corp & Blackstone who have aimed to raise 4,500 crores have already reached 59% of the subscription. They have got ?1,125 crores from strategic investment and ?1,159 crores from anchor investments.

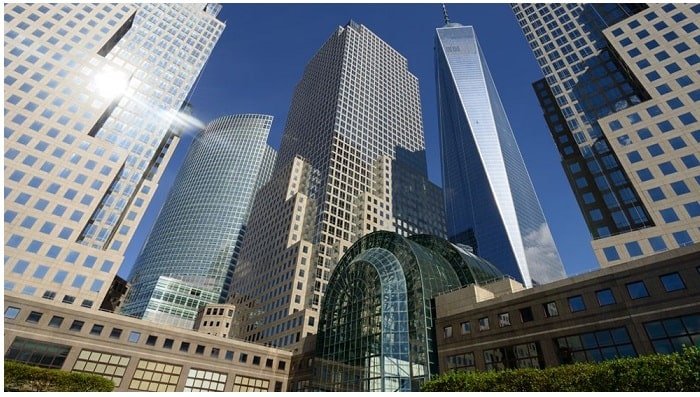

Brookfield Management has also announced that its REIT will be the first from other large global institutional investors. They have also acquired Hiranandani Group’s office and retails spaces in Mumbai, Powai suburb for about ?67 crores. It is India’s largest commercial space portfolio deal.

Earlier, they have acquired a 100% stake of Unitech Corporate Parks (UCP) in four special economic zones and a 60% stake in two other assets in the country worth ?3,500 crores. Also, they have acquired the remaining 40% in the two other properties.

Recently, they have acquired Jet Airways two-floor office in Godrej BKC in Bandra-Kurla Complex bringing the entire stake of Candor Investment of London Stock Exchange-listed India to focus realty investment firm UCP.